26 February 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

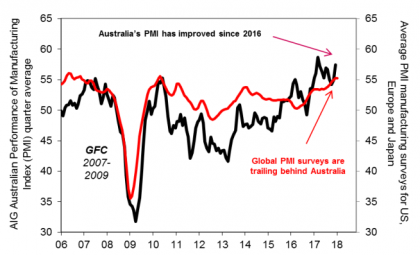

Australian manufacturing vs global surveys

View larger image

Sources: Australian Industry Group (AIG) Performance of Manufacturing Index (PMI) Markit Economics for Purchasing Managers Index

Australia’s manufacturing sector has struggled over recent years with intense global competition. Factory closures and large job losses were all too common across the landscape.

However since 2016, Australia’s manufacturing sector has improved. The AIG PMI survey shows that Australian manufacturing conditions (black line) are robust entering 2018. According to AIG, “January marked a sixteenth month of expanding or stable conditions for the Australian PMI® and the longest run of expansion since 2005.” Notably Australian manufacturers are seeing increased activity from “supplying upcoming infrastructure projects and the mining industry”. Remarkably, Australia’s PMI survey has even outperformed its global counterpart since the start of 2017 (red line).

While there are still some significant challenges in terms of high energy prices eroding profit margins, Australia’s manufacturers have entered 2018 with fire in the furnace rather than ashes.

Source: nab asset management 26 Feb 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group.

The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.